Visa, the world’s leader in digital payments, today announced key findings on how the spending habits and behaviors of Filipino consumers are changing as operating in the ‘new normal’ takes shape across the globe. These findings come from a Visa survey of consumers from across 40 countries worldwide, including the Philippines.

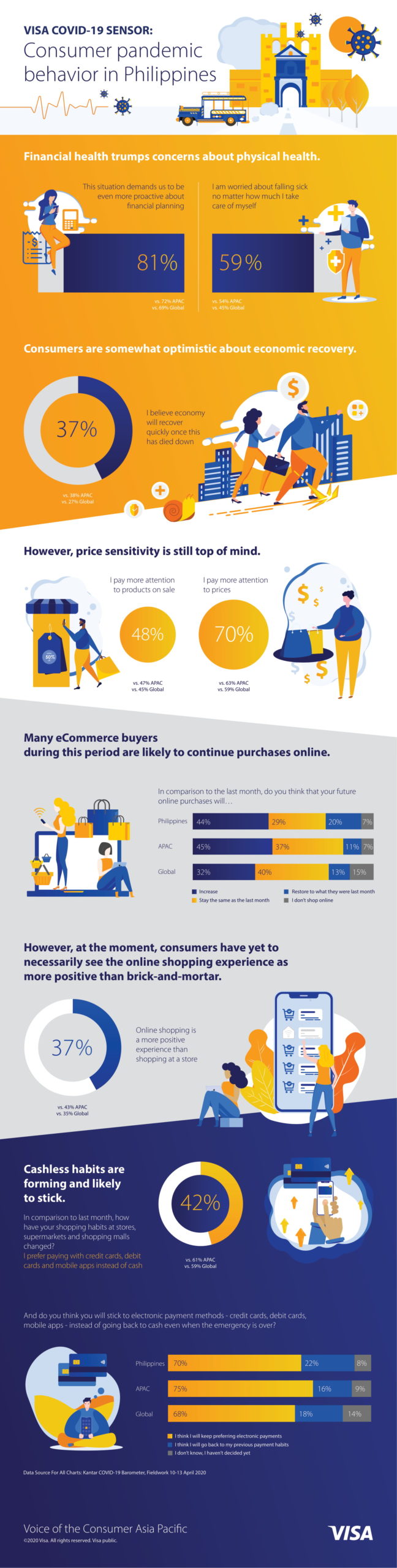

According to the Study, 70 per cent of Filipinos said they intend to stick with digital payment methods instead of reverting back to cash even when the current emergency is over. This is similar to Asia Pacific respondents (78%) and higher than the global shoppers (68%).

Dan Wolbert, Visa Country Manager for the Philippines & Guam said, “We approached the study with the intention to gain a timely, deeper and clearer understanding of how Filipino consumer behaviors are changing in the current environment. In this new normal, we’re seeing a shift – Filipinos are becoming more digital, and the COVID-19 situation has forced consumers to adopt this change in behavior.”

Based on the findings, 73 per cent of Filipino consumers said they are most likely to increase or sustain their current online shopping, similar to global shoppers (72 per cent).

“Based on our data, we see that one in six active Visa cardholders who have never made an eCommerce transaction in 2019 are shopping online for the first time this year. They are shopping for essential goods and services such as groceries, drugs and pharmaceutical goods and making bill payments for their telecommunication services. They are also making purchases for business services, showing a shift in small business owners making eCommerce purchases for business related services, added Dan.

When it comes to the shopping experience, 37 per cent of Filipino respondents said online shopping is a more positive experience than shopping at a physical store, higher than the global response (35%).

“The shift to eCommerce means that it is even more crucial that we work with our partners to streamline the online shopping experience for Filipinos in the country. Currently, we are working with new partners, including SMEs who have onboarded eCommerce platforms to enable digital payments acceptance and help drive a seamless and secure online shopping experience for Filipino consumers,” added Dan.

The study also shows cashless habits are forming across the globe with 42 per cent of Filipino respondents saying they prefer paying with cashless methods. This trend for the Philippines is slightly lower than Asia Pacific (61%) and global (59%).

“We hope these findings will spark conversation and drive collaboration amongst the payment ecosystem and beyond, as together we navigate these uncharted waters in the Philippines. Visa will continue to utilize its data, drive innovative practical solutions, and leverage the power of our global network to help businesses in the Philippines grow stronger as we enter the different phases of recovery,” Dan concluded.