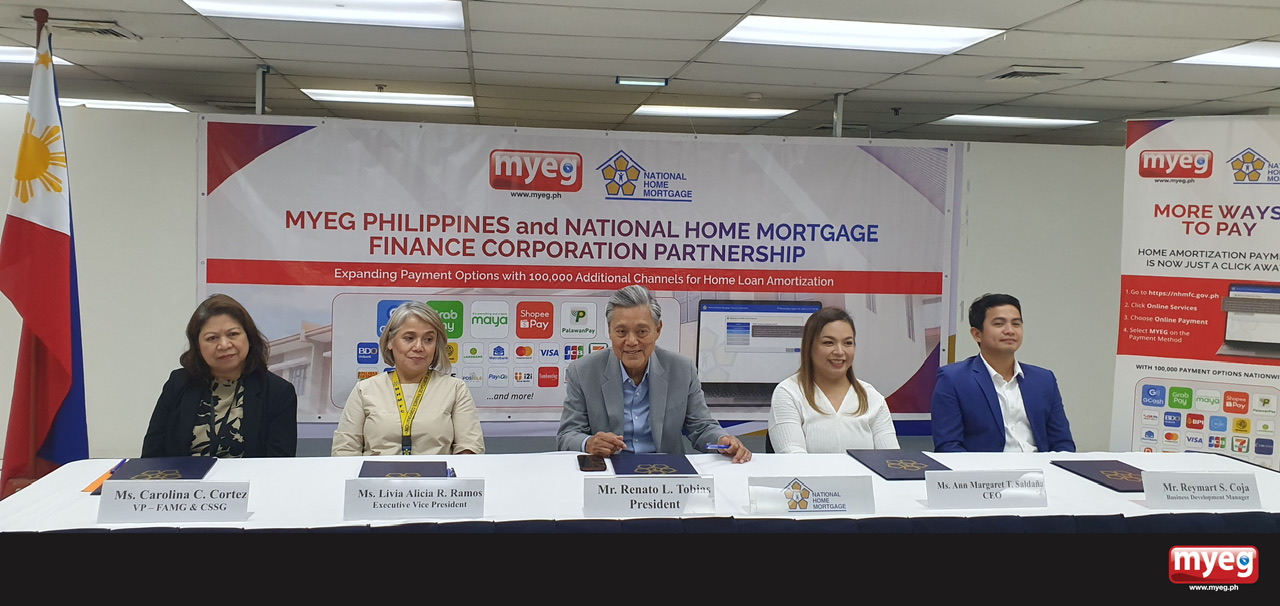

In the photo from left to right: Ms. Carolina C. Cortez, NHMFC VP for FAMG & CSSG; Ms. Livia Alicia R. Ramos, NHMFC Executive Vice President; Mr. Renato L. Tobias, NHMFC President; Ms. Ann Margaret T. Saldaña, MYEG PH Chief Executive Officer; and Mr. Reymart S. Coja, MYEG PH Business Development Manager.

In the photo from left to right: Ms. Carolina C. Cortez, NHMFC VP for FAMG & CSSG; Ms. Livia Alicia R. Ramos, NHMFC Executive Vice President; Mr. Renato L. Tobias, NHMFC President; Ms. Ann Margaret T. Saldaña, MYEG PH Chief Executive Officer; and Mr. Reymart S. Coja, MYEG PH Business Development Manager.

The National Home Mortgage Finance Corporation (NHMFC) has taken a significant step in enhancing its services by expanding its online payment options. In an official partnership with MYEG Philippines, Inc. (MYEG PH), NHMFC now offers citizens over 100,000 payment channels for their loan amortization, ensuring more accessible, convenient, and seamless transactions.

The Memorandum of Agreement was signed by MYEG PH Chief Executive Officer, Ms. Ann Margaret T. Saldaña, and NHMFC President, Mr. Renato De Leon Tobias, marking a milestone in improving the payment experience for NHMFC clients.

The newly introduced payment options include popular E-Wallets like Maya, GrabPay, ShopeePay, and PalawanPay; Credit/Debit Cards such as Mastercard, Visa, and JCB; and Bank Transfers from trusted institutions like BDO, BPI, RCBC, Maybank, and Metrobank. Additionally, citizens can now make payments through nationwide over-the-counter (OTC) channels such as Cebuana Lhuillier, Palawan Pawnshop, Bayad, 7-Eleven, RD Pawnshop, DA5, Posible, Pay&Go, USSC, i2i, ECPay, Tambunting Pawnshop, and countless others. For even more convenience, payments can also be made via QRPh through various banks and e-wallets including AllBank, PSBank, eCebuana, QueenBank, Sterling Bank of Asia, SeaBank, GoTyme Bank, AUB, and more.

A Seamless Payment Journey

NHMFC clients can now easily manage their loan amortization payments online. On the NHMFC Online Payment page (https://api.nhmfc.gov.ph/online-payment), users simply choose the transaction they wish to pay, enter the necessary details, select MYEG from the payment method dropdown, and choose their preferred payment mode and channel. Upon completing the payment, users will receive a Transaction Success Notification via email, confirming the payment.

Ms. Ann Margaret T. Saldaña, CEO of MYEG Philippines, expressed her enthusiasm about the partnership, stating, “We are thrilled to partner with NHMFC to bring more convenience to citizens across the country. By expanding payment options to over 100,000 channels, we are not only enhancing the ease of doing business with the government but also contributing to a more efficient and accessible public service.”

Mr. Renato De Leon Tobias, President of NHMFC, also shared his thoughts on the partnership: “This collaboration with MYEG Philippines aligns perfectly with NHMFC’s commitment to providing our clients with the best possible service. The expansion of our payment options demonstrates our dedication to making government transactions more user-friendly and accessible to all.”

The National Home Mortgage Finance Corporation (NHMFC) is a key government agency responsible for increasing the availability of affordable housing finance. Since its establishment, NHMFC has been committed to providing sustainable home financing options to Filipino citizens, empowering them to achieve homeownership through its various programs.

MyEG PHILIPPINES, INC. (MyEG PH), a market leader in electronic solutions championing government services online automation, has been providing eGovernment services in both Malaysia and the Philippines for the last 20 years through its technology platform encompassing the internet, automation, big data, and electronic payments.

This partnership between NHMFC and MYEG PH marks a significant advancement in the digitization of government services, reinforcing the commitment to enhancing the ease of doing business in the Philippines. The expanded payment options will undoubtedly lead to more convenient and efficient transactions, benefiting thousands of NHMFC clients nationwide.