Set to Tap Future Opportunities with Solid Position in Premium Markets

Embraces the Next Decade with Upgraded Core Strategy of “Smartphone X AIoT”

Xiaomi Corporation, an internet company with smartphone and smart hardware connected by an Internet of Things (“IoT”) platform at its core, today announced its unaudited consolidated results for the three and six months ended 30 June 2020 (“1H2020” or “the Period”).

1H 2020 Financial Highlights

- Total revenue amounted to RMB103.24 billion, representing an increase of 7.9% year-over-year (“YoY”), beating market consensus;

- Gross profit was approximately RMB15.26 billion, up 22.3 YoY;

- Profit for the period was approximately RMB6.65 billion, up 29.3% YoY, beating market consensus;

- Non-IFRS adjusted net profit was approximately RMB5.67 billion, down 0.7% YoY, beating market consensus;

- Earnings per share was RMB0.279.

Q2 2020 Financial Highlights

- Total revenue was approximately RMB53.54 billion, up 3.1% YoY and 7.7% quarter-on-quarter (“QoQ”);

- Gross profit was approximately RMB7.70 billion, up 6.1% YoY and 1.9% QoQ;

- Profit for the period was approximately RMB4.49 billion, up 129.8% YoY and 108% QoQ;

- Non-IFRS adjusted net profit was approximately37 billion, down 7.2% YoY, but increased by 46.6% QoQ;

- Earnings per share was RMB0.189.

Xiaomi Corporation said, “In the first half of 2020, despite the impact of COVID-19 and great global uncertainties, Xiaomi’s diversified business ecosystem has demonstrated its resilience, as both revenue and adjusted profits beat market consensus, while our operations continued to expand. We made the Fortune Global 500 list for the second time, ranking 422nd, up 46 places from last year. With 2020 being Xiaomi’s 10th anniversary, we have upgraded our core strategy to ‘Smartphone X AIoT’, with AIoT revolving around our core smartphone business, enabling us to lead the future way of smart living. Looking forward to the next decade, we will firmly adhere to our ‘three guiding principles’ – never cease to explore and innovate, continue to offer products with strong price-to-performance ratio, and seek to make the coolest products, so as to let everyone in the world enjoy a better life.”

Firmly Adhere to the “Three Guiding Principles” and Maintain Xiaomi’s Position in Premium Smartphone Market

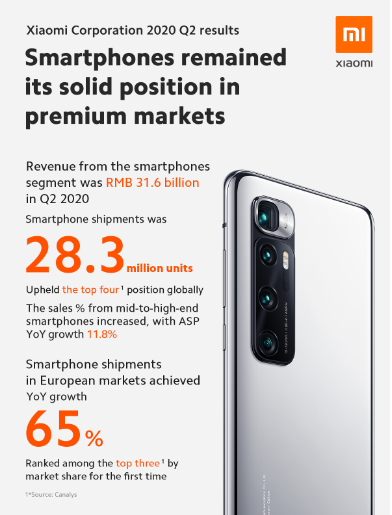

Amid the challenges brought by COVID-19 on the global smartphone market, Xiaomi adhered to three guiding principles – “never cease to explore and innovate, continue to offer products with the price-to-performance ratio”. Revenue from the smartphones segment was RMB61.952 billion and RMB31.628 billion in the first half and second quarter of 2020 respectively, and the smartphone shipments reached 28.3 million units.

According to Canalys, in the second quarter of 2020, Xiaomi ranked 4th globally in terms of smartphone shipments, and its market share stood at 10.1%. In overseas markets, shipments of its premium smartphones, with retail price of €300 or more, went up by 99.2% YoY in the second quarter of 2020. Driven by the higher proportion of sales from mid- to high-end smartphones, the average selling price (“ASP”) of the Group’s smartphones increased by 11.8% YoY and 7.5% QoQ.

The Group insisted on implementing the dual-brand strategy and yielded significant results. Xiaomi’s 5G flagship smartphones, Mi 10 and Mi 10 Pro, were launched in February 2020, the shipments have exceeded one million units within only two months. In August 2020, Xiaomi launched the Mi 10 Ultra, which achieved a DXOMARK score of 130 for overall camera performance, once again ranking 1st globally at the time of launch. The sales have exceeded RMB400 million after 10 minutes of its debut.

The Redmi brand continued to make 5G technology accessible to the mass market. In June 2020, the Group launched the Redmi 9A series which priced from only RMB499. It then launched the Redmi K30 Ultra in August, sporting all-around premium features with prices starting from only RMB1,999.

It is worth mentioning that Xiaomi also launched its smart factory recently with a total investment amount of RMB600 million, opening up an era of smart and manufacturing at Xiaomi’s factories. The Mi 10 Ultra is the first mass-produced ultra-high-end model of the Xiaomi Smart Factory.

Upgraded Core Strategy of “Smartphone X AIoT” to Build a Smart Life

Revenue from the IoT and lifestyle products segment was RMB28.237 billion and RMB15.253 billion in the first half and second quarter of 2020, respectively. Xiaomi’s global TV shipments still amounted to 2.8 million units, achieving YoY growth despite a decline in the overall TV market. According to All View Cloud (“AVC”), in the second quarter of 2020, the Group’s TV shipments in mainland China ranked 1st for the 6th consecutive quarter and ranked among the top five globally.

In the second quarter, Xiaomi introduced two flagship products under the new Mi TV Master Series, further expanding its footprint in the premium market. In July 2020, the Group introduced its first OLED TV, Mi TV Lux 65” OLED. In August 2020, it launched the second ultra high-end TV within the Mi TV Master Series–Mi TV LUX Transparent Edition, which is the world’s first mass-produced transparent TV.

To fulfill the various demands of the consumer worldwide, Xiaomi’s smart TVs entered more markets, including Poland, France and Italy during the second quarter. In July 2020, Xiaomi held its first global Xiaomi Ecosystem Product Launch and released a series of new products, including the Mi Smart Band 5 and Mi True Wireless Earphones 2 Basic.

Recently, Xiaomi Founder, Chairman and CEO Mr. Lei Jun distributed a letter to employee, announcing that Xiaomi’s core strategy will be upgraded to “Smartphone x AIoT” in the next decade to drive synergistic benefits, with smartphone remains as the cornerstone to the Group’s business, while AIoT will build a smart life around smartphones to let Xiaomi truly lead the future way of smart living

As of June 30, 2020, the number of connected IoT devices (excluding smartphones and laptops) on Xiaomi’s IoT platform reached approximately 271.0 million units, representing a YoY increase of 38.3%. The number of users who have five or more devices connected to Xiaomi’s IoT platform (excluding smartphones and laptops) increased to over 5.1 million, representing a YoY growth of 63.9%. Meanwhile, the Mi Home App had 40.8 million MAU, representing a YoY increase of 34.1%, in which non-Xiaomi smartphone users accounted for 67.9%. In June 2020, our AI Assistant (“小愛同學”) had 78.4 million MAU, an increase of 57.1% YoY.

Xiaomi continued to strengthen the interconnectivity across products with the “Xiaomi Share” initiative. “Xiaomi Share” supports always-on access to music, video and voice calls when switching across multiple devices. In addition, the Group developed the multi-screen collaboration function, which support cross-device photographing and document editing. Going forward, the Group will continue to enhance the connectivity between smart devices, and offer more intelligent user experiences and application scenarios, thereby bringing global Xiaomi users to the forefront of future smart living.

Increasing Contribution of Diversified Internet Services to the Group’s Revenue

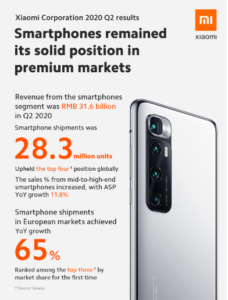

Revenue of the internet services segment amounted to RMB11.808 billion and RMB5.908 billion in the first half and second quarter of 2020 respectively. In the second quarter of 2020, the MAU of MIUI increased by 23.3% year-over-year to 343.5 million, while the mainland China MAU of MIUI was 109.7 million.

In the second quarter of 2020, advertising revenue increased by 23.2% YoY to RMB3.1 billion, driven by the rapid growth in overseas advertising revenue, as well as the gradual recovery in advertising budgets in mainland China. Internet services revenue outside of advertising and gaming from mainland China smartphones, including those generated from the Youpin e-commerce platform, fintech business, TV internet services and overseas internet services, increased by 39.5% YoY, accounting for 39% of its total internet services revenue.

In June 2020, MAU of Xiaomi smart TVs and Mi Box reached 32.0 million, an increase of 41.8% YoY. As of June 30, 2020, the number of paid subscribers increased by 33.1% YoY to 4.0 million.

Business in Overseas Markets Grows Steadily Despite Headwinds

Remains the 1st in Western Europe among major players by Smartphone Shipments Growth Rate

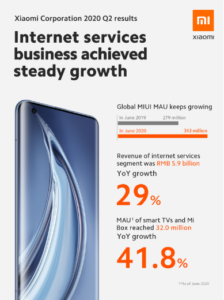

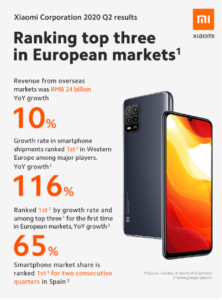

Revenue from overseas markets was RMB48.861 billion and RMB24.029 billion in the first half and second quarter of 2020 respectively. According to Canalys, in the second quarter of 2020, Xiaomi’s market shares in terms of smartphone shipments ranked among the top five in 50 countries and regions and reached the top three in 25 of these markets.

In the second quarter of 2020, according to Canalys, Xiaomi’s smartphone shipments grew by 64.9% YoY in Europe, achieving a total market share of 16.8%, ranking it in the top three for the first time. In Western Europe, the Group’s smartphone shipments grew 115.9% YoY, accounting for a 12.4% market share. The Group’s smartphone shipments in Spain grew by 150.6% YoY, ranking 1st for two consecutive quarters with a 36.8% market share. During the quarter, Xiaomi ranked 2nd in France and 4th in Germany and Italy, in terms of smartphone shipments.

In Eastern Europe, Xiaomi became the No.1 smartphone company in Ukraine and Poland in terms of smartphone shipments, with respective market shares of 37.1% and 27.5%. In addition, in the second quarter of 2020, the Group captured a market share of 30.7% by shipments in the Indian smartphone market. According to IDC, it retained the No.1 position in the Indian smartphone market for the 12th consecutive quarter.

Impact of the COVID-19 outbreak

In the second quarter of 2020, the COVID-19 pandemic affected Xiaomi’s global operations to varying degrees. In April and May 2020, several of the Group’s key markets implemented strict lockdown measures and the sales were greatly impacted. As business restrictions were gradually lifted, sales have recovered tangibly.

In India, strict lockdown measures were imposed starting in late March and our sales were significantly impacted during the lockdown period. As India gradually lifted the restrictions during the second quarter of 2020, consumer demand started to rebound. In July 2020, the average daily number of smartphone activations in India returned to 72% of the pre-pandemic level recorded in January. In July 2020, excluding India, the average daily number of overseas smartphone activations had reached 120% of the pre-pandemic level recorded in January.