Filipinos are now scrambling to keep their home supplies at bay, as the deadly novel coronavirus (COVID-19) has spread in various parts of the country, and a community quarantine has been ordered in certain areas of the archipelago.

In Metro Manila alone, some grocery stores have seen their shelves almost wiped out of stocks, as people stockpile their homes with food and other grocery items to prepare their families for more stringent quarantine measures.

This means that the exchange of paper money is faster than ever, and money is circulating from one hand to another without prejudice to whoever handled the banknotes before people and merchants ultimately keep them in their wallets or cash registers.

Paper money, according to various studies, can harbor the viruses and bacteria that they contract with for several days. This may include the deadly novel virus that has forced the world into a pandemic.

And in the Philippines, where cash is still king, the virus may potentially spread through the exchange of paper money, which circulates not only in one area but can go anywhere where payment is demanded.

Aside from practicing personal hygiene, the World Health Organization (WHO) has already encouraged everyone to use contactless payment solutions to avoid viral transmission via banknotes and coins.

Thus, it is high time for Filipinos to consider using frictionless payment methods such as mobile wallets. Through mobile apps, account holders may transact with a wide variety of merchants without physically touching paper money. They may also use their mobile phones to pay for bills, settle for government dues, or even support humanitarian efforts to combat the dreaded disease.

GCash, the leading mobile wallet in the Philippines, is encouraging Filipinos to adopt a more digital lifestyle, especially at times like these, when crises strike everyone the hardest.

“At this trying time, every one of us should adopt measures that will reduce our risk of contracting the virus from any surface — and that includes paper money. We at GCash believe that there is power in technology, and Filipinos could benefit from this, especially during emergencies,” GCash President Anthony Thomas said.

The digital economy helps lessen the risk of transmission for those who leverage it, as it limits the physical interaction between people and leverages new technologies to facilitate services.

Transferring funds to loved ones in the provinces

For instance, a man who works in quarantined Metro Manila may send money to his loved ones in Bicol via GCash. He may either send the money to their GCash wallets or even transfer funds from his GCash account to their bank accounts via the Bank Transfer option in the GCash app.

The funds transferred may then be used by his family to purchase their everyday goods, pay for services, and even pay for their bills.

No queues at payment centers

Speaking of paying bills, with social distancing protocols now in place, queuing at payment centers also increases the risk of spreading the virus.

By using the GCash Pay Bills service, anyone with a GCash account may settle their utility bills, credit card bills, cable and internet bills, insurance, real estate, and even government dues without going out of the comforts of their homes.

Get things delivered

Likewise, instead of going to supply stores, GCash users may use their GCash wallets to shop online. Through its partnership with Lazada, which has the widest arrays of goods being sold, GCash users may opt to buy their grocery items or even daily necessities via their mobile phones. The items they purchased will then be delivered to their doorsteps, reducing their risk of contact to the virus.

Pay with credit lines

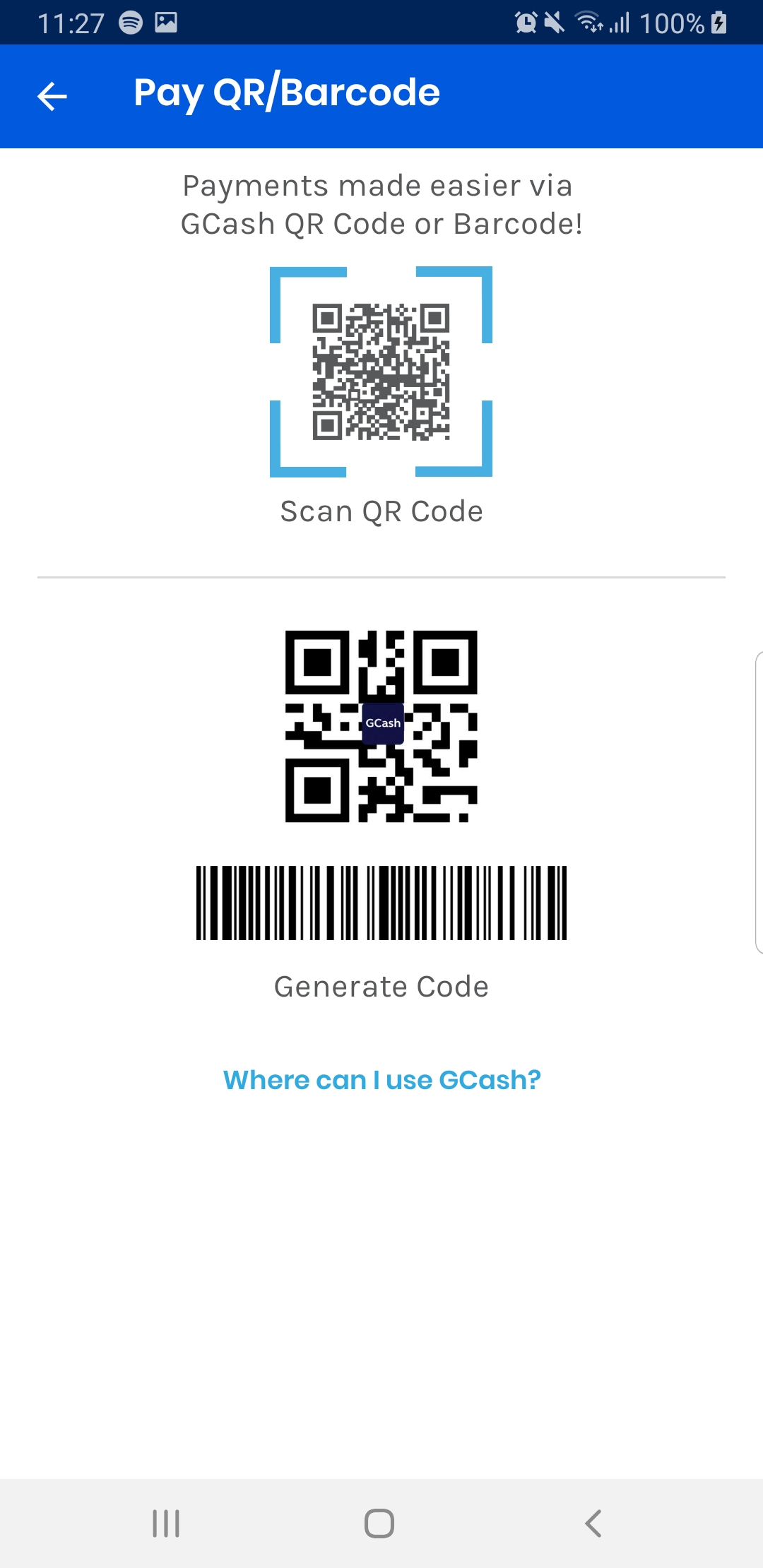

But if it is really necessary to go outside and buy daily necessities from the grocery store, GCash users may also use their mobile wallets to purchase goods via the revolutionary Scan-to-Pay (STP) via QR or STP via Barcode payment systems, which are accepted in over 70,000 merchants in the country. They may either use their available balance or tap into GCredit, a credit facility embedded in the GCash app, to transact with grocery stories like Puregold.

Savings in times of emergencies

GCash users with GSave savings accounts may also digitally cash out their money when emergencies arise. The money, when cashed out from the GSave account, directly goes into the GCash wallet balance, and instead of physically cashing the money out of ATMs, they may opt to use their digital wallets to transact with various merchants across the Philippines.

Not the only risk reduction measure

These are just some of the services that Filipinos may benefit from during the global pandemic. But while frictionless payments reduce the risks of spreading the virus, everyone should still keep in mind that proper hygiene, as directed by the Department of Health, should be thoroughly and strictly practiced.

“We have to work together as a team — albeit following social distancing protocols — to defeat this almost invisible enemy. We at GCash are exploring more ways to help the government and the private sector in mitigating the further spread of COVID-19 in the country,” Thomas said.