It has been a two weeks since the government officially announced a community quarantine in all of Luzon due to novel coronavirus (COVID-19) pandemic. People are instructed to stay at home in hopes to control the virus transmission and prevent the numbers from increasing. This change might be sudden, but it is undeniable that the economy is already experiencing drastic repercussions due to this global crisis.

The COVID-19 pandemic has affected the world economy in unprecedented ways. Never before in most of our lifetimes has the nation been through a period where people have been asked to stay home, work remotely if possible, or not work.

The social distancing measures being taken are grounded in science, as the goal is to “flatten the curve” in an effort to slow the spread of the virus. Ultimately, it will help save lives and reduce the health effects of the pandemic, which is the primary goal right now.

How it is affecting Filipinos using traditional bills payments processes?

Many Filipinos still use traditional payment of their bills through payment center (bayad center) or direct payments to the company. Filipinos are usually paid cash or checks. There are now many ways to avoid paying cash or checks without interruption to their day-to-day activities or to distract from their work or home. It is through E-wallet, credit card, online payment or cashless transaction to prevent the spread of theft and prevent the handing of money in our hands which caused the pandemic or virus in our country or in the whole world, to cause or control money where we get or transmit various viruses that are already in the possession of money and transmitted to other people.

But today, Filipino introduce and encourage consumers to purchase online through alternative online payment methods. E-wallets and payment gateways are bringing bank and non-bank payment options to the table. One of the companies offering online and cashless transactions is GCash.

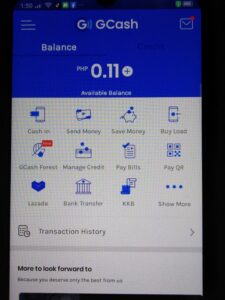

GCash, the leading mobile wallet in the Philippines, is encouraging Filipinos to adopt a more digital lifestyle, especially at time like these, when crises strike everyone the hardest. GCash, a micropayment service that transforms the mobile phone into a virtual wallet for secure, fast, and convenient money transfer, and Fuse, a tech-based lending company that enables Filipinos to get microloans to business loans without the traditional requirements set by banks and other lending institutions.

“At this trying time, every one of us should adopt measures that will reduce our risk of contracting the virus from any surface — and that includes paper money. We at GCash believe that there is power in technology, and Filipinos could benefit from this, especially during emergencies,” GCash President Anthony Thomas said.

Nowadays there are many ways we can pay our utility bills, bank transactions or we can even send money to our family through GCash whether work at home or somewhere else. This is a procedure in preventing the spread of coronavirus COVID-19 in our country and around the world. By using GCash we avoid interacting with other people and distance to ourselves from them in preventing spread of the virus.

“VIRUS PARTICLES WILL BE ABLE TO SIT AND ATTACH THEMSELVES TO PAPER NOTES AND COINS, POSING A HUGE RISK TO THE SPREAD OF INFECTION AS THE MONEY WILL BE TRANSFERRED OVER AND OVER AGAIN FROM PERSON TO PERSON INCREASING THE LIKELIHOOD OF A FURTHER SURGE OF PEOPLE INFECTED. THE BEST THING TO DO IS TO TRY AND USE YOUR CARD, CONTACTLESS OR APPLE PAY WHEN YOU CAN.

While contactless payments are recommended in place of cash transactions as a way to limit infection, they still harbor germs; microorganisms are able to transfer via point-of-sale terminals and ATMs. It’s especially crucial to avoid cash payments when paying for utility bills, food and other bills, with World Health Organization (WHO) stating that everyone “should wash their hands or use a hand sanitizer after handling money, especially if they are about to eat, or before handling food.”

How to use the GCash App?

Turn your smartphone into a virtual wallet—that’s what using the GCash app is all about.

A mobile payment innovation in the Philippines, GCash has revolutionized the way people make financial transactions. With just a few taps on a smartphone, Globe and TM subscribers can quickly send and receive money, pay bills, and make other transactions anytime and anywhere. All GCash services are free, except for cash out and GCash card application and withdrawal.

For non-tech savvy beginners, learning how to use the GCash app can be quite challenging and even frustrating. Planning to use GCash?

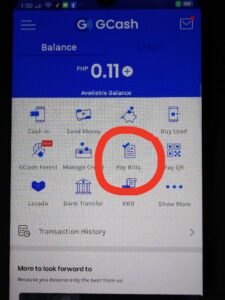

How do I pay my bills with GCash?

- Download the GCash App through Google Store or App Store.

- Register to GCash.

- Log on to your account on the app.

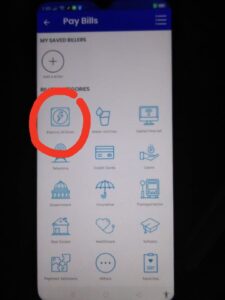

- Click “Pay Bills” on the lower part of the screen.

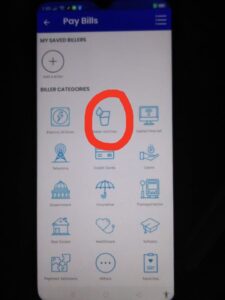

- Click on “Utilities”.

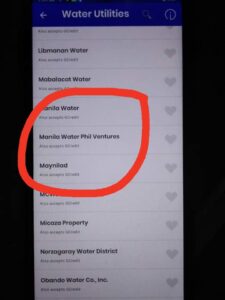

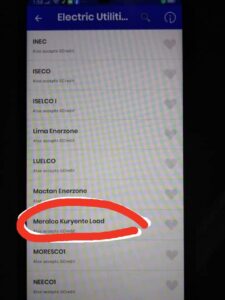

- Choose the desired biller (Meralco, Manila Water, or Maynilad Water).

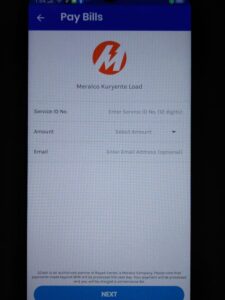

- Input the details required.

We highly recommend and encourage the Filipino to use and innovate themselves the new technology and less transaction using paper money to use the GCash App in their daily transaction to keep away from any virus that has come to our country.

For further information or you may download the GCash App in the following app stores:

Google Play: https://play.google.com/store/apps/details?id=com.globe.gcash.android&hl=en

Apple Appstore: https://apps.apple.com/ph/app/gcash/id520020791

Stay smart in making sure you’re doing your part in keeping safe, and always make it a habit to wash your hand and sanitize your phones!